I'm Beau Eckstein, your Business Ownership Coach | Investor Financing Podcast host, and today I want to walk you — as a busy medical professional — through practical, semi-absentee franchise opportunities that let you earn semi-passive income while you maintain a clinical career. Over the last two decades I've financed and advised entrepreneurs, and in the video that inspired this article I broke down why franchising can be an ideal path for physicians, dentists, nurse practitioners and other healthcare providers looking for diversification, tax benefits, and long-term equity building.

Why franchising makes sense for busy medical professionals

Franchising is a massive industry — even if you only think of retail chains, there are more than 3,000 franchise concepts across the U.S. In the United States alone franchising contributes roughly $760 billion annually to the economy. For medical professionals who want to protect time while building additional income streams, franchising provides three critical advantages:

- Proven systems and playbooks you can plug into immediately.

- Support infrastructure (marketing, training, software) to reduce hands-on time.

- Financing options and tax strategies that can accelerate payback and reduce taxable income.

If you're working 40+ hours in a clinical role, the idea is not to switch careers immediately — it's to find a business model that allows you to contribute 10–20 hours per week or even less, by hiring a strong manager and following a replicable blueprint.

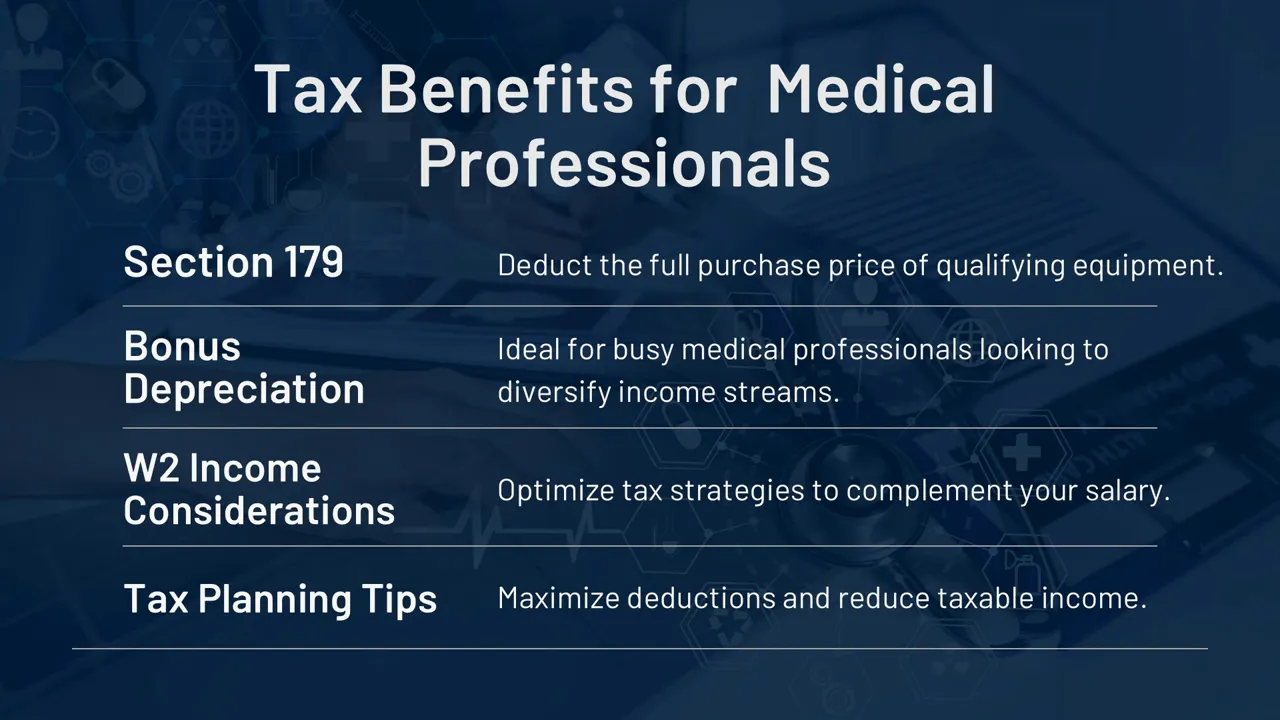

Tax strategies, Section 179, and the triangle approach

One of the strongest reasons many high-earning medical professionals explore franchise ownership is tax optimization. I call my approach the triangle: tax strategy, real estate ownership, and operating businesses. When structured correctly — and after you consult a CPA and attorney — a franchise can generate meaningful deductions through:

- Section 179 — allows you to deduct the cost of qualifying equipment and vehicles in the year of purchase.

- Bonus depreciation — an additional depreciation strategy for certain assets.

- Pass-through entity optimization (S-corp, LLC, partnership) — which, combined with deductions, can offset W-2 income.

Example: if you buy a $100,000 service van and equipment for a home-service business and structure it as a pass-through entity, subject to proper advice and qualification, you may be able to materially offset earned income through current-year deductions. This is why I always recommend bringing a small-business CPA into the conversation early.

What semi-absentee franchising really is — models explained

There are several franchise ownership models that suit different lifestyles:

- Owner-operator: You work in the business full-time; not a fit if you want to stay clinical.

- Semi-absentee: You hire a general manager and spend roughly 10–20 hours per week on high-level oversight, sales, and decisions.

- Managed or absentee: The franchisor or a hired management team runs day-to-day operations while you stay hands-off.

- Multi-unit / multi-brand: Own several territories or different brands to scale revenue and build a diversified portfolio.

Most medical professionals I work with prefer semi-absentee ownership — you stay connected, ensure quality, and protect the asset while maintaining your clinical practice. It's vital to hire a manager who executes the franchisor blueprint and to become fluent in key performance indicators (KPIs) and P&L oversight so you can measure success without being on every call.

Skills that will make you successful running a semi-absentee franchise

You don't need industry-specific technical experience to run many of the service franchises I recommend. For example, an HVAC brand I work with signed dozens of operators with no HVAC background. The real skills you should develop are:

- Leadership and culture building — the moment you have employees, culture drives retention and service quality.

- Sales and customer development — even semi-absentee owners should be involved in strategic client relationships.

- Financial literacy — reading a P&L, understanding margins, and tracking monthly KPIs.

- People management — hiring skilled managers and contractors, and holding them accountable.

Franchisors provide training on operations and sales; you provide the leadership to execute consistently in your market.

Financing your franchise: SBA, ROBS, and smart leverage

One of the biggest advantages of franchising is that it is generally easy to finance compared to buying an independent small business. Here are the common funding options I discuss with clients:

- SBA loans — can finance a large percent of the total project; many lenders underwrite on projections and some will fund up to 80–90% of startup costs.

- ROBS (Rollover for Business Startups) — use retirement funds to invest without early withdrawal penalties if executed correctly.

- Alternative financing — equipment financing, merchant cash advances, or small business lines of credit.

We typically build three-year financial projections (monthly for years one and two) to present to lenders. Good debt — from an SBA loan — is often preferable because your cash-on-cash return and the time to recoup your equity are crucial metrics. For some franchise concepts, you can be “all in” for $100,000 with an equity injection far lower thanks to financing options.

Real franchise examples that fit the semi-absentee model

Three brands I highlighted as solid examples for busy professionals are:

- Home Smiles — 18 home services delivered via an executive, no-brick-and-mortar model. They focus on recurring revenue from property managers, facility managers, and realtors. The model emphasizes instant pipeline setup before opening and low overhead.

- Color World — a painting and home-improvement franchise with a “six-in-one” revenue stream (residential painting, commercial painting, drywall, holiday lighting, power washing and gutters, and a cabinet finishing partnership). Many owners run it from home with storage only.

- Environ Master — commercial deep-cleaning and sanitation services targeting restaurants, retail, daycares, and high-traffic facilities. Historically, a standard territory investment is about $360k (including one year of working capital); they also offer an individual operator option for ~$115k. The average gross revenue per single-unit standard franchise in 2022 was approximately $1.1M — a testament to recurring B2B contracts and strong margins.

These examples show the variety available: consumer-facing home services, specialty contracting/painting, and business-to-business recurring services. Each has a different time-to-break-even, recurring revenue profile, and operational footprint.

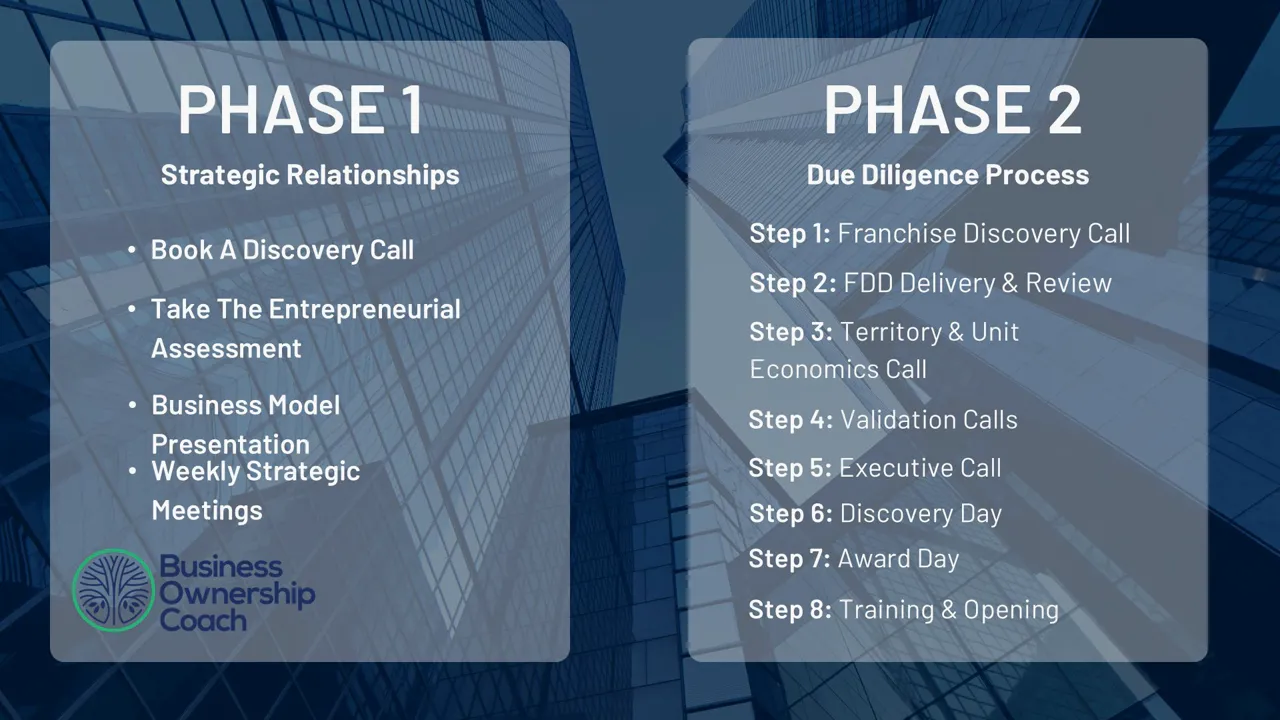

The franchise selection and buying process — step-by-step

Choosing the right franchise is a process, not a transaction. Here is the path I recommend:

- Take an entrepreneurial quiz to clarify appetite, available time, and capital.

- Book an initial 30-minute discovery call to uncover goals and constraints.

- Receive a business model review: 7–12 concepts tailored to your market and preferences.

- Do deep dives into your top 2–3 choices: talk to franchisor leadership and existing franchise owners, review marketing, training, and financials.

- Carefully review the FDD (Franchise Disclosure Document). Pay attention to item 7 (investment range) and item 19 (earnings claims).

- Do validation calls, attend discovery day, secure territory, and finalize financing.

This process can take 5 weeks for someone moving quickly — or a year+ for buyers who want to take their time. My role as a Business Ownership Coach | Investor Financing Podcast host is to guide you, provide introductions to lenders, and ensure you make an educated decision.

Scaling, exit strategy, and planning for 5–10 years

Think of a franchise like a real estate remodel: your equity grows as the business matures and revenue increases. Recurring revenue businesses command higher multiples at exit. Typical planning horizons I work on with clients are 3–10 years depending on whether you want to:

- Replace clinical income and transition out of your job.

- Build a sellable asset to pass to family or sell to private equity.

- Hold long-term for cash flow and diversification.

Start with the end in mind. If your goal is to sell in 5–7 years, target recurring-revenue, contract-backed models that deliver predictable cash flow and strong margins.

How I work with aspiring owner-operators and semi-absentee buyers

My approach is consultative and no-cost to you: I don’t charge prospective buyers. I get paid by franchisors after a successful investment, so my job is to help you be committed to the discovery process — not to force a sale. Typical next steps with me are:

- Take a 30-question quiz so I can tailor options.

- Schedule a 30-minute discovery call.

- Receive a curated list of 7–12 business models and a one-hour model review.

- Move into deeper conversations with 2–3 preferred franchisors and secure financing if you decide to proceed.

We also host quarterly Business Ownership Summits where we bring franchisors and CPAs to discuss tax strategies and financing specifics. That event is a great way to compress your learning curve without obligation.

Conclusion — next steps if you’re a medical professional ready to explore

If you're a medical professional curious about building semi-passive income through franchising, take a structured approach: clarify your goals, learn the options, and use financing and tax strategies to accelerate success. As your Business Ownership Coach | Investor Financing Podcast host, I’m committed to helping professionals like you find the right model, understand the math, and build a sellable asset over time.

If you’re ready to begin, take the quiz, book a discovery call, and let’s design a personalized thesis for your business ownership journey.