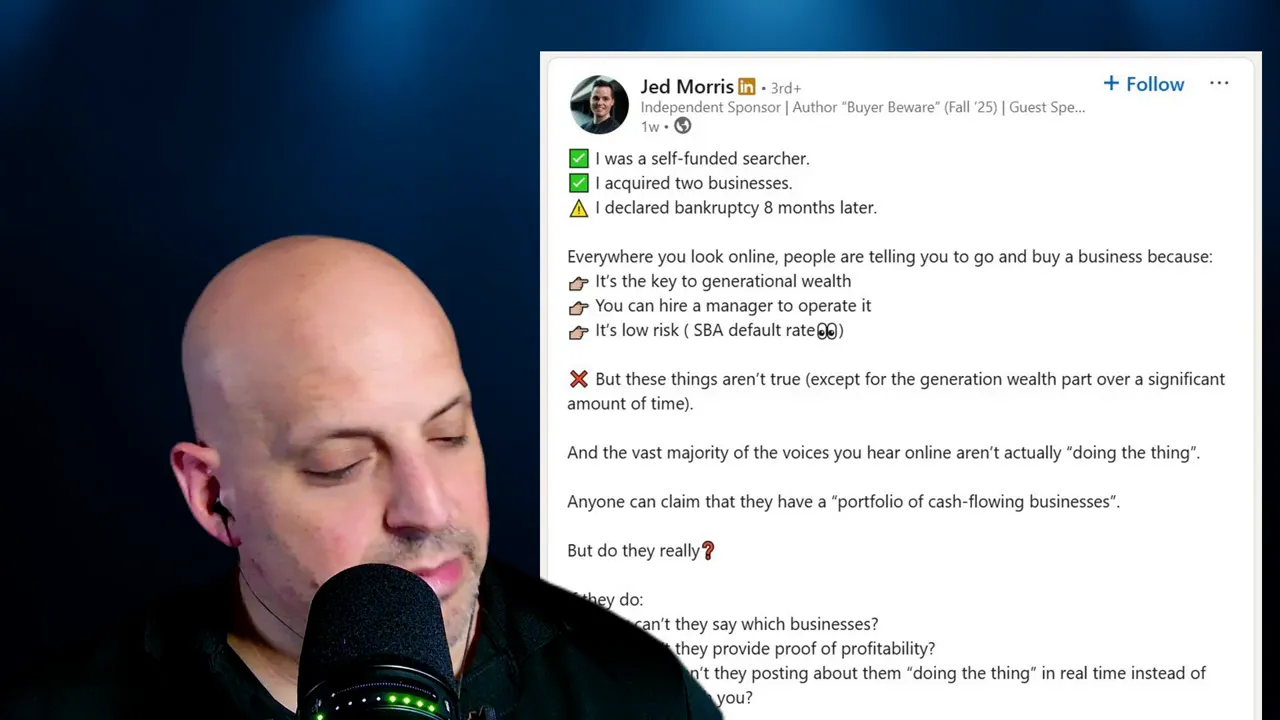

In this post I’m unpacking a short but powerful story that landed on my LinkedIn feed — a self-funded searcher who bought two businesses and declared bankruptcy eight months later. As the host and Business Ownership Coach | Investor Financing Podcast, I want to walk you through what likely went wrong, why the online narrative around buying a business can be dangerously misleading, and how you can avoid the same mistakes.

The Viral LinkedIn Post That Stopped Me Scroll

I saw a post from someone I wasn’t connected with that began, “I was a self-funded searcher. I acquired two businesses. I declared bankruptcy eight months later.” That kind of brutal honesty cuts through the noise. It also reveals a pattern I see over and over: people buy into the glamor of business ownership without fully appreciating the operational reality.

As a Business Ownership Coach | Investor Financing Podcast, I believe transparency like this is helpful. It forces us to ask better questions before we pull the trigger on an acquisition.

Why the Online Hype Can Be Dangerous

Everywhere you look, the message is loud and simple: buy a business, hire a manager, and cash flows toward generational wealth. That isn’t always false — owning operating businesses can create lasting wealth — but it’s incomplete and often misleading.

People online often omit the messy middle: the months (or years) of onboarding, the revenue dips after transition, hiring mistakes, licensing headaches, and the reality that many investors are not actually running the businesses they tout. As a Business Ownership Coach | Investor Financing Podcast, I’ve watched too many buyers underestimate these variables and pay a heavy price.

The Myth of Semi-Absentee Ownership

Photo by Nicolas J Leclercq on Unsplash

Franchisors love the term “semi-absentee.” It sells dreams. And yes, some businesses can become semi-absentee over time — typically certain retail or low-complexity food businesses. But “become” is the operative word.

If you’re buying while keeping a W-2 job, expect to work two jobs for the first 12–24 months. You will be hiring, training, and fixing problems. You’ll be the person ensuring the GM understands systems and culture. Semi-absentee is a long-term goal, not a starting point.

When sellers or influencers promise a turnkey escape, proceed with skepticism. A thorough buyer prepares for heavy lift up front and plans for how they will transition to a lighter role, if that’s even the right goal.

What Goes Wrong When You Buy Too Fast

Photo by Vitaly Gariev on Unsplash

There are several pitfalls I see repeatedly:

- Over-leveraging: Buying multiple businesses at once strains cash flow and attention.

- Poor diligence on operations, staff, and customer retention.

- Assuming revenue will stay the same during a transition.

- Underestimating licensing, compliance, or local regulations.

- Relying on “manager will run it” without a rigorous hiring and training plan.

In the LinkedIn case, it wasn’t clear whether two locations were sold together or if this buyer purchased two distinct companies. Both scenarios can amplify risk. If you’re buying with finite capital and experience, starting with one location and proving concept is often the wiser path.

Photo by Vitaly Gariev on Unsplash

Lessons From Lending, Franchises, and Real Investing

My background — 27 years in lending and real estate and eight years funding SBA loans — taught me that nothing is easy and every investment is a learning experience. Early flips and investments teach patterns that repeat across business ownership: there’s always something that shows up unexpectedly.

Large, experienced investors often make owning multiple cash-flowing businesses look easy because they have capital and high-quality teams to do the heavy lifting. If you’re starting with limited funds and experience, plan to be hands-on and allocate time for steep learning curves.

Coaching, Education, and Measuring ROI

Photo by Vitaly Gariev on Unsplash

Coaching can accelerate learning if the coach brings real, verifiable experience. I work with a business and personal coach weekly and have invested in targeted programs when the expected ROI is clear. But not every coaching offer is created equal.

Before investing, verify a coach’s credentials, ask for case studies, and consider whether you can learn the basics independently first. I prefer a layered approach: consume free and low-cost resources to build a foundation, then invest in higher-ticket coaching when the path and ROI are clear.

The Triangle Method: Taxes, Operating Businesses, and Real Estate

I often refer to the Triangle Method: tax strategy, operating business, and buy real estate. Together, these three cornerstones can build sustainable wealth. But each corner requires work and expertise. You don’t shortcut the operating business corner and expect the triangle to stand.

Practical steps I recommend:

- Start with one location or business and prove the numbers.

- Plan for two years of hands-on effort, especially in service and B2B sectors.

- Build systems and hire a GM with a phased transition plan.

- Validate your cash flow before buying additional locations or territories.

- Use automation and virtual assistants to scale well after systems are proven.

Checklist: How to Avoid the “Bought Two, Bankrupt in Eight Months” Trap

Before you sign on to buy any business, run this quick diligence checklist:

- Financial audit: 3+ years of P&L, owner’s discretionary earnings, and cash flow sensitivity.

- Operational audit: key employees, dependency on seller relationships, documented systems.

- Transition plan: seller training period, overlap, and employee retention strategy.

- Capital buffer: enough working capital for at least 6–12 months of unexpected shortfalls.

- Contingency: exit and recovery plan if things go sideways.

If you want help with any of this, I offer assessments and financing guidance — and you can book time through bookwithbeau.com. I will say again as the Business Ownership Coach | Investor Financing Podcast, careful diligence and realistic expectations beat hype every time.

Conclusion: Start Realistic, Scale Intentionally

Buying a business can create long-term generational wealth, but it is not a shortcut. The story of someone buying two businesses and filing for bankruptcy eight months later is a reminder: the path to ownership requires preparation, capital buffers, hands-on work up front, and a willingness to learn.

If you’re serious about taking the step, start smaller, run disciplined due diligence, and build systems that allow you to scale rather than burn out. As a Business Ownership Coach | Investor Financing Podcast, my goal is to help you make wiser acquisitions and build durable businesses that actually create the wealth you want.

Resources I referenced in the episode:

- Book a call for SBA financing and business assessments: bookwithbeau.com

- Join the Business Ownership Academy: businessownershipacademy.com

- Free ebook on VAs and AI systems: bisscalingplaybook.com